European Merchant Insight Report

Solving the post-pandemic payments puzzle: How can merchants and acquirers satisfy consumer demand?

What's in

THIS

REPORT?

EUROPEAN MERCHANT INSIGHT REPORT

Tribe's latest research report is based on a survey of 400 merchants, both e-commerce and multichannel, across five key European markets.

The aim of this research was to understand what payments issues and initiatives merchants are focused on as they resolve to meet consumer demand.

We also dive into the areas where merchants are seeking support and how payment partners and acquirers can help.

REPORT CONTENTS

ONLY AVAILABLE IN THE FULL REPORT ⬇️

- Merchants' biggest challenges for the year ahead

- Mid-term: The three-year plan

- Further down the line: The next five years

Merchant-Acquirer relationships

- Merchants' perceptions and expectations

- Why merchants chose their current acquirer

- What would make merchants switch provider

Conclusion: How acquirers and payments partners can support merchant success.

Executive Summary:

How can merchants and acquirers keep up with consumer demand?

‘The customer is king’ is a motto that has been etched on the walls of companies everywhere, regardless as to whether they’re start-ups or corporate juggernauts.

Everyone is well aware how technology has revolutionised our lives, and it will continue to do so in ways that we can’t even imagine right now. Few sectors have felt the impact of tech more than merchant and financial services sectors, where technology advancement has been on a collision course with consumer demand.

And it’s not just what customers want, but also how they want it. User experience is everything in 2022 – and that extends all the way through to the payments process (and beyond).

So, are merchants and acquirers keeping up with consumer demand? Are we likely to see the end of cash, or even cards, in the immediate future? And what challenges and opportunities lie in store over the next few years in the payments sphere?

Tribe set out to analyse a number of trends to form a picture of the evolution of merchant payments. Our survey project was designed to assess several key areas, including:

- The current payment trends and key functionalities already supported by merchants

- The biggest payment challenges that merchants are facing right now, and what they find most difficult to overcome

- The opportunities merchants see to diversify and grow, along with what changes they are planning to make in order to keep up with consumer demand

- The challenges – and predicted hurdles – that will further shape the payment landscape over the next five years, and how acquirers and payment partners can successfully support merchants

To get a benchmark, we asked merchants about their perceptions of and relationships with acquirers and payment partners – both positive and constructive. From here we also explored the reasons why merchants selected their existing acquirers and what would potentially drive them to switch to a new provider.

Our aim in doing this was to explore, at a very practical level, the potential for acquirers to enhance their success and sustainability as a business, by understanding and addressing the needs of today’s merchants and the challenges and opportunities on the road ahead.

To build this picture, we scoped and commissioned a survey of 400 small and mid-sized merchants across key European markets: Germany, Spain, the Netherlands, Lithuania and the UK.

Popular payment methods.

-

98% of merchants offer card schemes to their customers; still the dominant payment method across Europe

-

66% of merchants support payments via Apple Pay, Google Pay and Samsung Pay; the adoption of alternative payment methods (APMs) varies wildly across different countries, mobile wallets in particular are leading the way

-

11% of merchants support Buy Now, Pay Later; despite the hyped potential of BNPL, it’s yet to gain much traction among multichannel merchants.

Current payments challenges.

-

The most overwhelming concerns from merchants are around costs, trend visibility and the ability to adapt to changing customer demand, particularly when it comes to delivering the right customer experience.

-

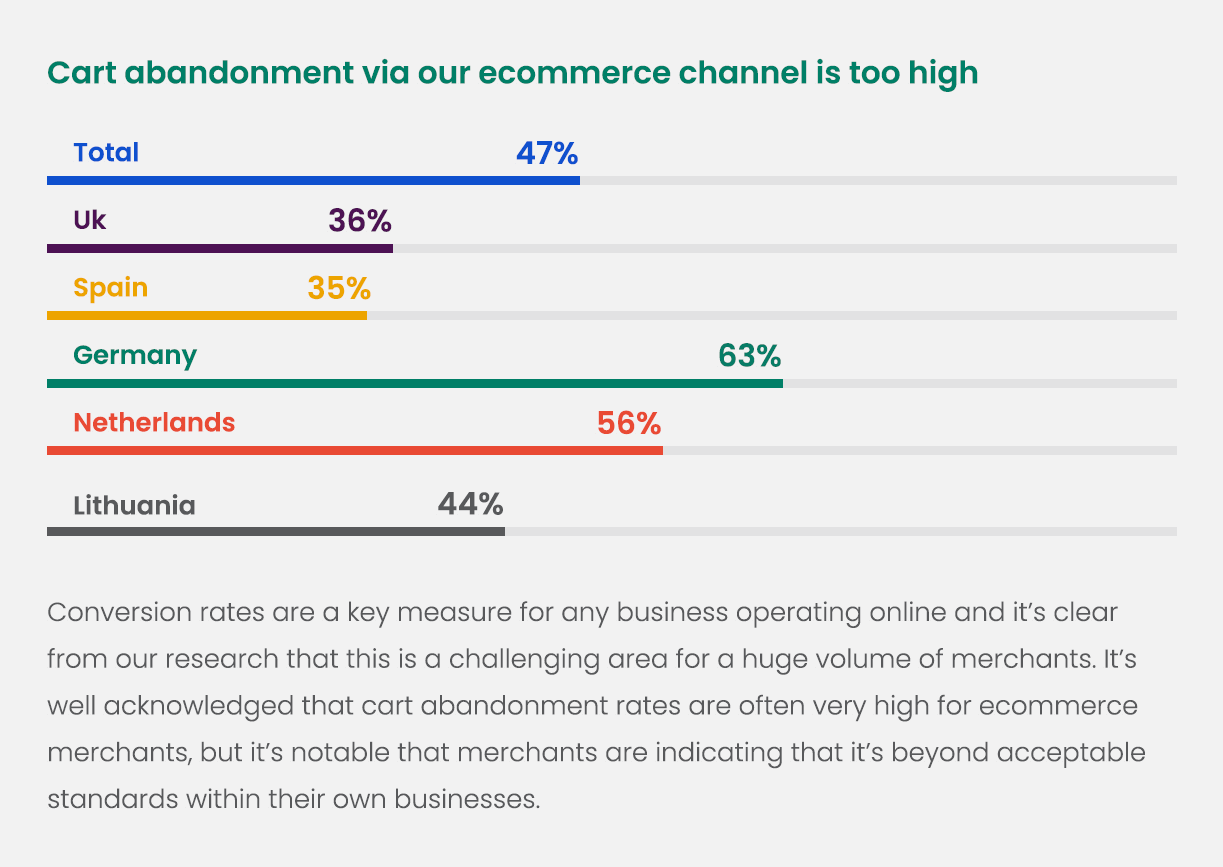

Cart abandonment continues to be an ongoing battle for merchants, with nearly half expressing that their e-commerce checkout dropout rates were too high.

-

One of the most interesting points raised was that a large proportion of merchants don’t feel they have enough understanding of popular payment methods, or the ability to add new payment methods with relative ease.

Future developments and opportunities.

We also explored the key changes that merchants are looking to implement over the next 12 months, three years and five years.

The opportunities that merchants are focused on differed greatly by market, for instance:

-

The UK, Spain and the Netherlands are more focused on expansion into other markets

-

In Germany and the Netherlands, businesses are focussed on their omnichannel offer and launching their own payment options.

Perceptions of acquirers and relationship gaps.

In general, the majority of merchants say they are relatively comfortable with their acquirer or payment partner and their ability to support their business needs. However, among the grievances that merchants shared, were concerns about rising costs, a lack of support and advice from their payment partners and their propensity to switch providers in exchange for greater flexibility and better technology.

BACK TO CONTENTS LIST⬆️

Current Trends

State of p(l)ay: Current payment facilities

Our first point of exploration was to assess what payment functionalities merchants already have in place. Throughout the course of this report, you’ll find analysis of merchants that operate with an e-commerce-only presence, and those ‘multichannel’ merchants that combine e-commerce with a physical store.

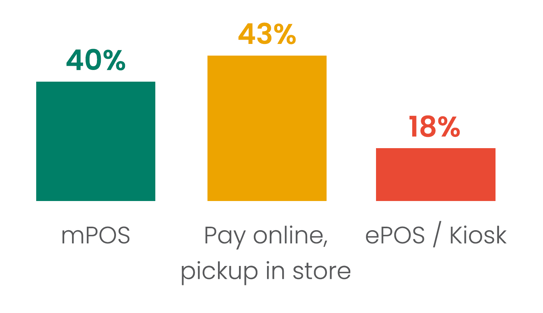

At least 4 in 10 multichannel merchants support mPOS and ‘click and collect’ transactions, more than double the amount of those that support ePOS / Kiosk payments. It’s also worth highlighting that there is great variation of mPOS figures between countries: 55% of British merchants have it in place, double the average among the surveyed nations. In contrast, it’s offered by just 5% of German merchants.

Multichannel merchants support for payment channels beyond the traditional terminal:

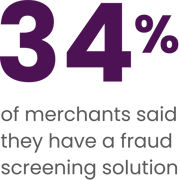

Across all merchants, investment in critical payment functions is lower than expected. We found that 1 in 3 merchants surveyed have fraud prevention screening solutions and multiple currency options in place, but there is a fair amount of variation between countries. Over half of all Dutch merchants (55%) have fraud solutions in place, with the other countries all hovering around the average (the UK sits just behind at 1 in 5).

With click and collect services, the UK leads the way with over 1 in 3 merchants offering the service, compared with an overall average of 22% - with just 9% of Dutch merchants offering the service. This is a notable area of interest for other markets in the coming years (SEE PAGE XX).

Multi-currency functionality

Meanwhile, the prevalence of multi-currency options proves to be a big differentiator; over half of all German and Dutch merchants have it in place, compared with an average of 11% between the UK, Spain and Lithuania.

There was also a notable difference in the provision of multiple currency options between multichannel (40%) and e-commerce merchants (24%). In some cases this could be due to the volume of e-commerce merchants operating on a domestic level only, but, given the opportunity to attract greater volume of cross border transactions, it’s surprising that so many e-commerce players don’t already have a multi-currency offering in place.

State of p(l)ay: Payment Method Popularity.

Traditional card schemes dominate the European landscape

We then asked merchants what payment methods they offered their customers, as well as what their customers opt to use. For clarity, the answer options to the latter question were ‘very regularly’, ‘somewhat regularly’, ‘not very regularly’, and ‘hardly ever.

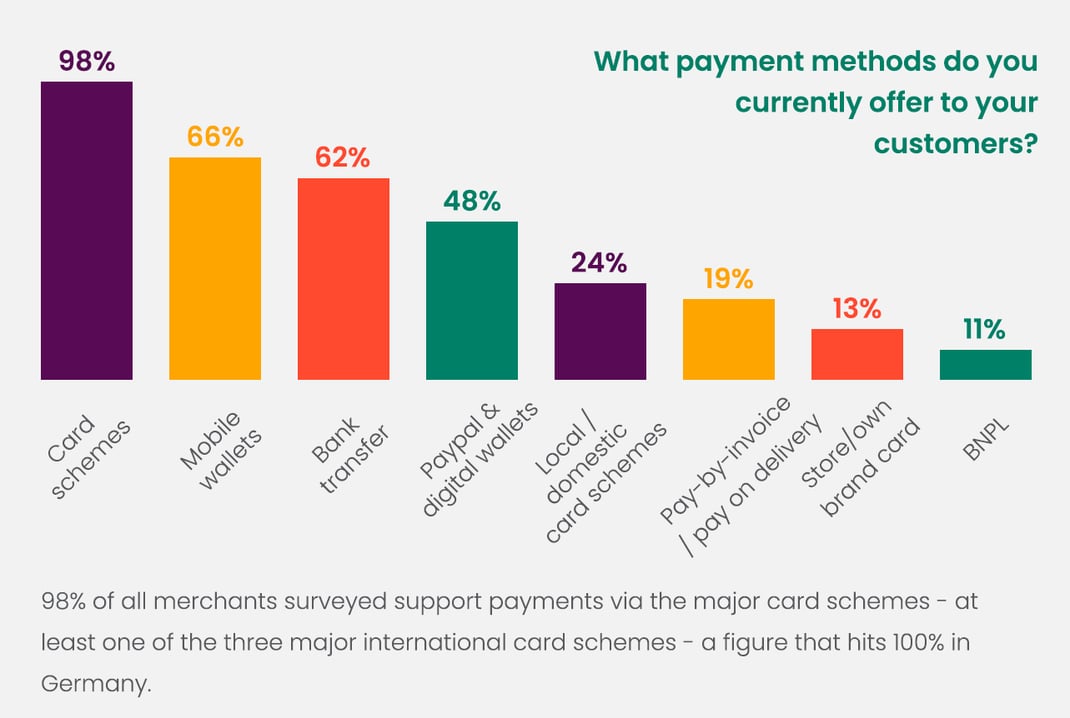

While cards are firmly still the dominant payment method offered, 2 in 3 merchants also support mobile wallets (Apple Pay, Google Pay and Samsung Pay) as a payment method, closely followed by bank transfer, which includes Open Banking payments (62%). One notable aspect about these two methods was the contrasting results from surveyed countries.

While 76% of merchants in Spain, the UK and Lithuania offered mobile payments, this figure dropped to 53% in Germany and the Netherlands. Conversely, when it comes to offering bank transfers, 84% of German and Dutch merchants offered it, compared with just 45% of merchants in the other three nations.

What else is on offer? Next up is Paypal and digital wallets; while options such as local card schemes and pay-by-invoice are offered up by a quarter and a fifth of merchants respectively. The new kid on the block – BNPL (Buy Now Pay Later) is offered by just 11% of businesses.

Are reports of a cashless society premature?

Nestled in the middle of these payment methods is cash, which is offered by half of all merchants across the board, with the only exception being Lithuania at 44%. Furthermore, surveyed firms report 56% of customers use cash very regularly as a payment method.

With respect to customer usage, it was a mixed bag for APMs. Bank transfers and mobile wallets performed strongly, used very regularly by 49% and 46% of customers respectively. Meanwhile, just 7% very regularly used the newfangled BNPL (Buy Now Pay Later), with Paypal and other digital wallets used by 24%.

UK (🇬🇧)

-

Card schemes are offered by 97% of merchants, with mobile wallets the only other method offered by more than half of all merchants (75%).

-

Usage figures mirror what’s offered with card schemes the dominant payment method, followed by mobile wallets, which are used ‘very regularly’ by 71% of customers

-

Although offered by just 1 in 3 merchants, PayPal and other digital wallets are used by 56% of customers where offered

Spain (🇪🇸)

-

Mobile wallets offered by 81% of merchants, compared with the overall average of 66%, and they are used ‘very regularly’ by 67% of customers, a higher figure than card schemes.

-

Nothing else besides those two methods is ‘very regularly’ used by more than 36% of consumers, and Spain has quite a fairweather culture with ‘somewhat regularly’ dominating most replies

Germany (🇩🇪)

-

96% of consumers very regularly use cash where offered, which equals that of card schemes

-

Together with the Netherlands, bank transfer is offered by more than 80% of merchants; while the other three surveyed nations poll at less than 1 in 2

-

Bank transfers then sit at 61% ‘very regular use’ by consumers, with just 1% ‘not very regularly’

-

Pay-by-invoice has a notable 94% ‘somewhat regular’ use

-

Mobile wallets and BNPL lag behind at 3% and 6% respectively

The Netherlands (🇳🇱)

-

97% of shoppers very regularly use cash

-

Bank transfer offered by 84% of merchants, and used very regularly by 73% of consumers

-

No one uses BNPL very regularly, and it’s split almost 50/50 between ‘somewhat’ and ‘not very’ regularly

Lithuania (🇱🇹)

-

Mobile wallets leads the way with 2 in 3 customers using it very regularly, followed by Paypal at 60%

-

Traditional card schemes share the same usage figure as Paypal, but it’s also notable that it’s offered by ‘only’ 94% of merchants. All the countries are 97% or higher.

-

Less than 1 in 10 customers use bank transfer as a method of payment very regularly.

A key driver for conducting this research was to understand the areas of payments that merchants are finding difficult to tackle – and where their payment partners or acquirers could potentially help.

Challenge 1: High e-commerce cart abandonment rates

Challenge 2: Delivering the right experience at the checkout

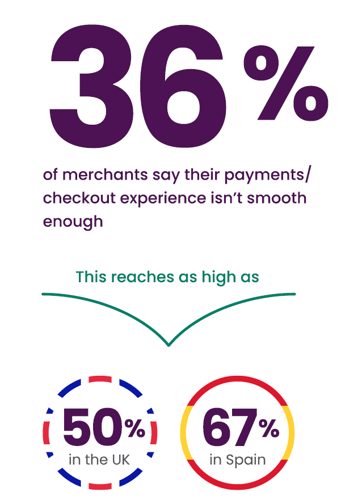

There’s little dispute that a slick customer experience is the absolute minimum that any merchant has to deliver – whether that’s instore or online. But over a third of merchants acknowledge that their payments experience isn’t yet up to standard – something that could be a significant contributor to the high levels of cart abandonment.

What’s even more concerning is that in certain markets, this shortfall in customer experience is an issue for over half of the merchants we surveyed.

Challenge 3: Lack of visibility around trends and customer data

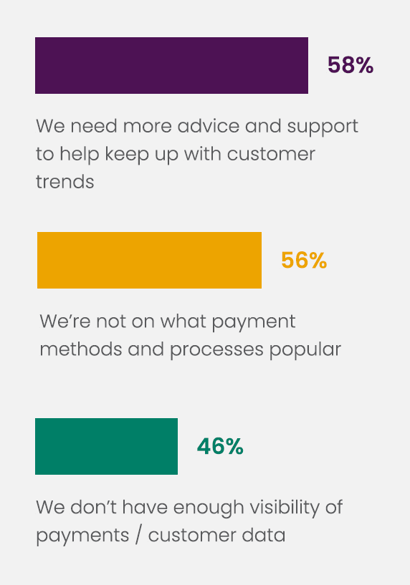

Delivering the right customer experience at the checkout is also now contingent on the ability to offer customers’ preferred payment methods and a personalised service.

To achieve this, merchants need to keep their finger on the pulse of what their customers want, how they shop, how they prefer to pay and in what currency, among other things. Unfortunately, this seems to be one of the biggest challenges that merchants are facing.

Of course, there is some variance across both merchant type and market. For instance, pure e-commerce players are struggling more in this area than their multichannel counterparts – they are less clear on which payment methods and processes are popular.

Lack of visibility of payments/customer data is a problem for nearly half of all businesses, and even more of an issue in the UK, Spain and Lithuania.

Almost 6 in 10 Lithuanian merchants suffer from this issue, as do 53% of Spanish and British businesses. The overall average of 46% is identical when it comes to e-commerce only or multichannel companies.

A lack of visibility of data may also be part of the reason why so few merchants currently offer multi-currency options. Without the understanding of where their shoppers are coming from, or the origins of their issuing banks, for instance, it can be hard to determine what currencies to support and whether offering different options is a valid investment.

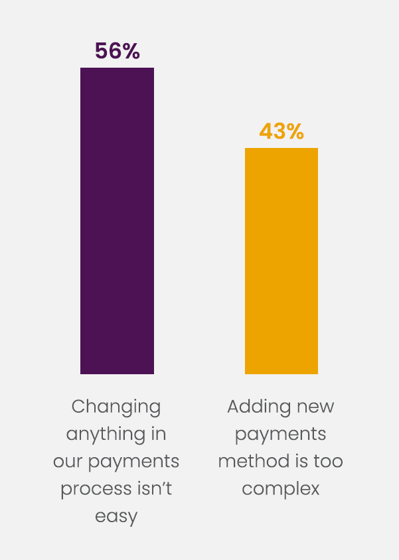

Challenge 4: Difficulty adapting to changing trends

It’s no surprise that without access to the right insight, adapting to changing consumer preferences will be a huge challenge. But even once furnished with the right information, the need for simplicity and flexibility in payments technology is critical. Around half the merchants we surveyed found this kind of change a real challenge.

.png?width=137&height=90&name=Payments%20Awards%20(1).png)

.png)